Car depreciation calculator tax deduction

By entering a few details such as price vehicle age and usage and time of your ownership we use. 06 11 25 86 05 Mail.

Pin On Mission Organization

SLD is easy to calculate because it simply takes the depreciable basis and divides it evenly across the useful life.

. That said there are better options available than a depreciation calculator for your car. SLD is easy to calculate because it simply takes the depreciable basis and divides it evenly across the useful life. Depreciated value according to your Wear and Tear calculator was.

Nclex results on hold 2021. R311416 5 year write-off -----Now Im a little confused sorry Do I skip the. In 2021 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 100 of the purchase.

The car depreciation calculator allows you to find the market value of your car after a few years. Heres an easy to use calculator that will help you estimate your tax savings. If you qualify to.

It can be used for the 201314 to 202122 income years. AFTER FIVE YEARS. Standard Mileage Deduction Business mileage IRS standard mileage rate Non-Commuting Parking Tolls.

Raiffeisen bank international ag investor relations. As with any tax. 100 First-Year Depreciation for Qualifying Models.

This limit is reduced by the amount by which the cost of section 179 property placed in service during the tax year exceeds 2550000Also the maximum section 179 expense deduction for. When its time to file your. You can generally figure the amount of your deductible car expense by using one of two methods.

For a summary of this content in poster. So 11400 5 2280 annually. To calculate the depreciation of your car you can use two different types of formulas.

This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. Deductible amount for 2015. 2 lieu dit Vallières 37360 Neuillé Pont Pierre.

Simply enter in the purchase price of your equipment andor software and let the calculator take care of the rest. Starting with general information like the make model year and features of the vehicle. To calculate your deduction multiply the number of business kilometres you travel in the car by the appropriate rate per kilometre for that income year.

Most calculators use data including. It will then depreciate another 15 to 25 each year until it reaches the five. Cost of Running the Car x Days you owned 365 x.

Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. Use this depreciation calculator to forecast the value loss for a new or used car. The depreciation cost limits are indexed once a year based on the year-on-year movement if any in the motor vehicle purchase sub-group of the consumer price index for the.

As a business owner you can claim a tax deduction for expenses for motor vehicles cars and certain other vehicles used in running your business. We will even custom tailor the results based upon just a few of. The IRS standard mileage rate changes annually.

You need to keep records Where you. When its time to file your. Income Tax Age Calculator.

Prime Cost Method for Calculating Car Depreciation. The standard mileage rate method or the actual expense method. A vehicle expense calculator helps you calculate the amount you can claim as a tax deduction for work-related car expenses for eligible vehicles.

So 11400 5 2280 annually. This new car will lose between 15 and 25 every year after the steep first-year dip.

Ay 2022 23 Depreciation Rate Chart As Per Income Tax Act 1961 Income Tax Taxact Income

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Usa Real Estate Agents Tax Deduction Cheat Sheet Are You Claiming All Your Allowable Expenses Real Estate Checklist Real Estate Tips Real Estate Marketing

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Business Tax Deductions Tax Deductions Small Business Tax Deductions

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

.png)

Car Depreciation For Taxes The Ultimate Guide Keeper Tax

Real Estate Lead Tracking Spreadsheet

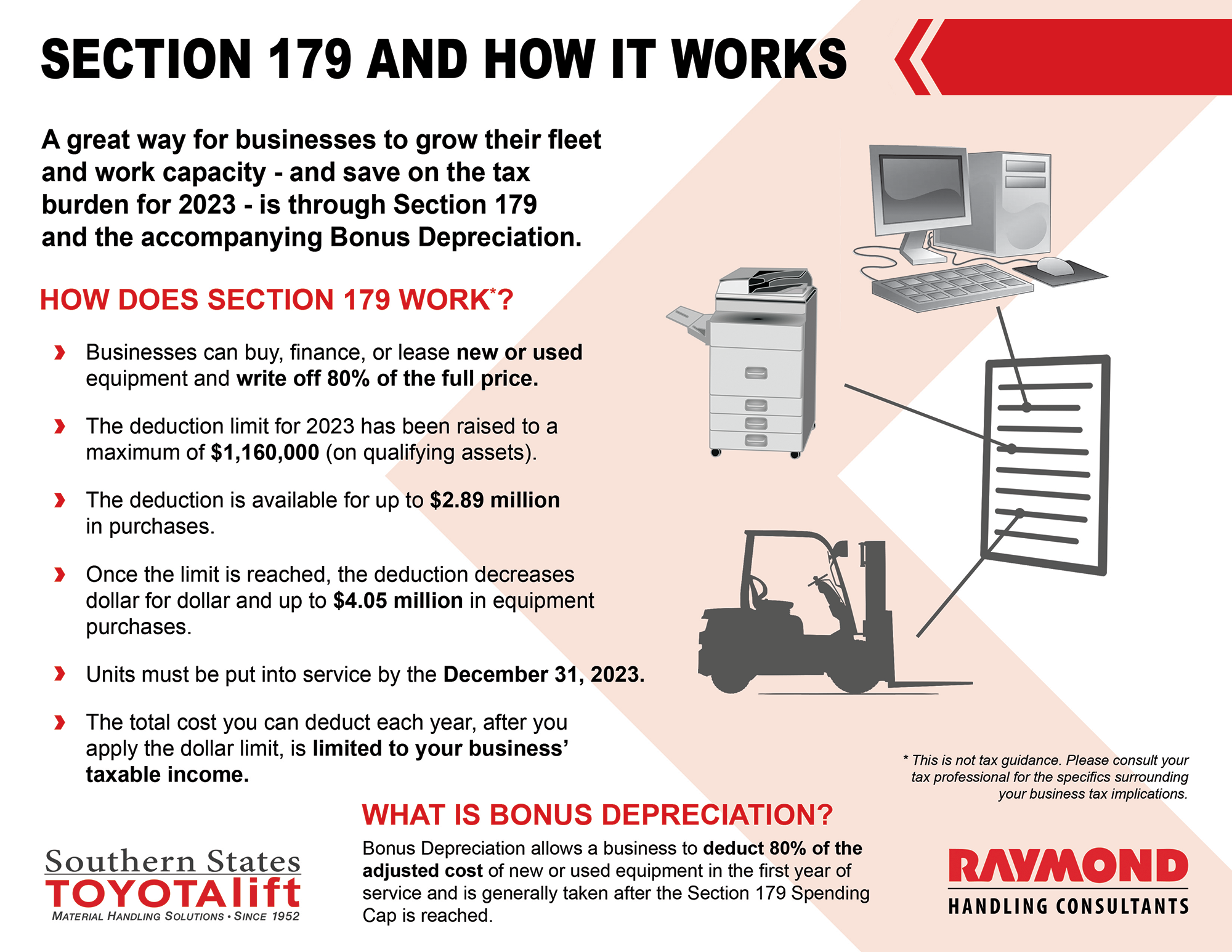

Section 179 Deduction Hondru Ford Of Manheim

Section 179 Bonus Depreciation Saving W Business Tax Deductions Envision Capital Group

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Free Macrs Depreciation Calculator For Excel

Using The Section 179 Tax Deduction For New Forklift Purchases In 2021

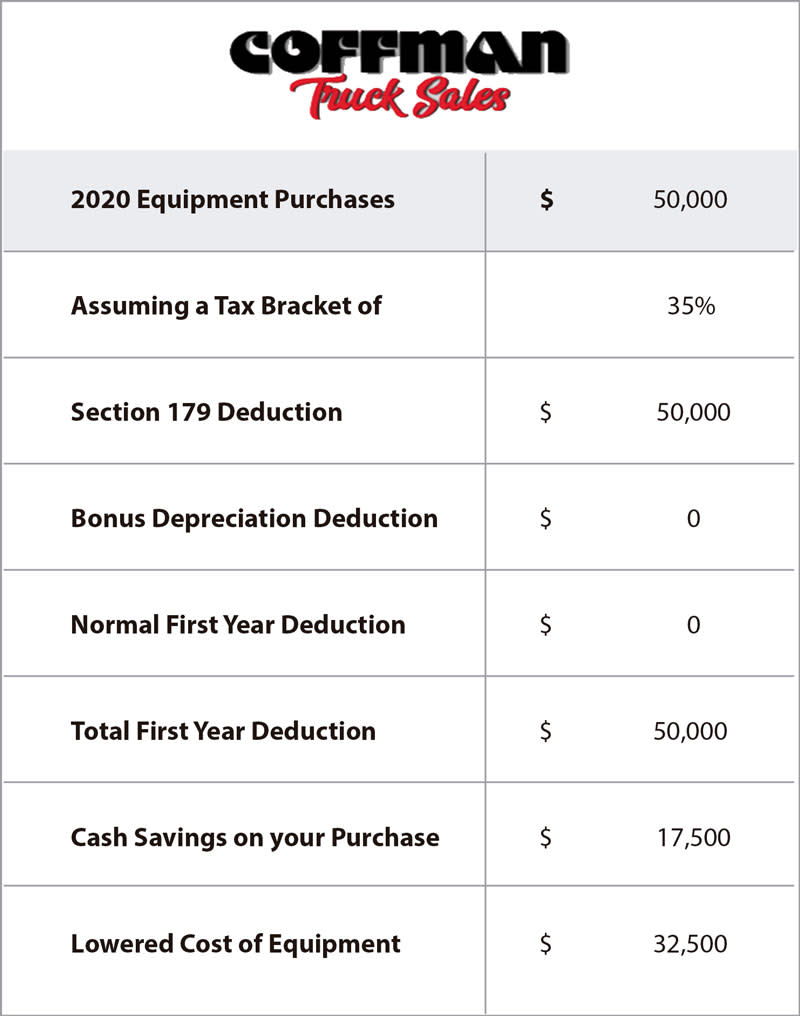

Section 179 Tax Deduction Coffman Truck Sales